idaho sales tax rate in 2015

Ad Lookup Sales Tax Rates For Free. Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3.

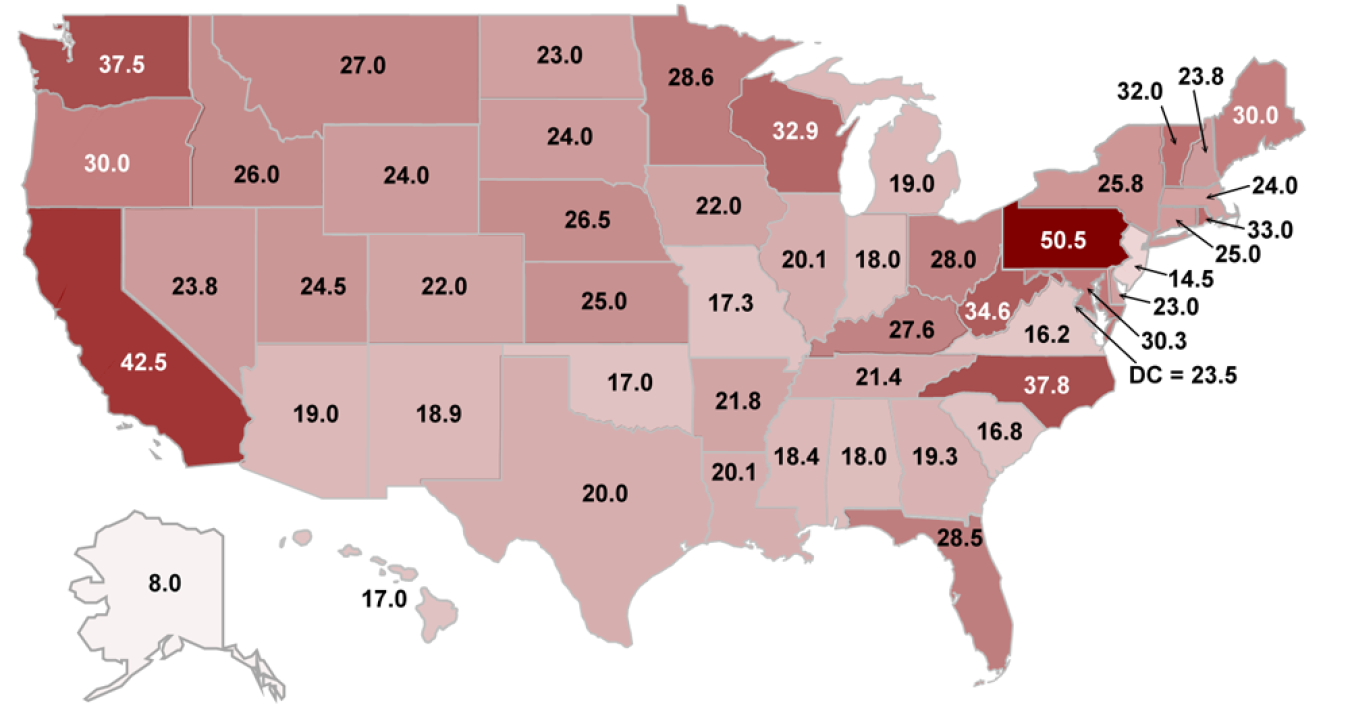

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020.

. Tax rate may be adjusted annually according to a formula based on balances in the unappropriated general fund and the school foundation fund. L Local Sales Tax Rate. Interactive Tax Map Unlimited Use.

Calculate By Tax Rate or calculate by zip code. While many other states allow counties and other localities to collect a local option sales tax Idaho does. We strongly recommend using a sales tax calculator to determine the exact sales tax amount for.

The Montana sales tax rate is 0 as of 2022 and no local sales tax is collected in addition to the MT state tax. Object Moved This document may be found here. Plus 45 of the amount over.

Average Sales Tax With Local. The tax data is broken down by zip code and additional locality information location. Counties and cities can charge an.

Enter zip code of the sale location or the sales tax rate in percent Sales Tax. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. S Idaho State Sales Tax Rate 6 c County Sales Tax Rate.

Prescription Drugs are exempt from the Idaho sales tax. Calculate By ZIP Code or manually enter sales. The 95 sales tax rate in Los Angeles consists of 6 California state.

ID Combined State Local Sales Tax Rate avg 604. 278 rows Idaho Sales Tax. Sales Tax Rate s c l sr.

Food sales subject to local. The Idaho State Idaho sales tax is 600 the same as the Idaho state sales tax. With local taxes the total sales tax rate.

2022 Idaho Sales Tax Table. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020. Plus 31 of the amount over.

Sr Special Sales Tax Rate. 31 rows The state sales tax rate in Idaho is 6000. 10 of the amount over 0.

ID State Sales Tax Rate. 2022 Idaho Sales Tax Table. Our dataset includes all local sales tax jurisdictions in Idaho at state county city and district levels.

The state sales tax rate in Idaho is 6 but you can customize this table as needed to reflect your applicable local sales tax rate. So whilst the Sales Tax Rate in. The Idaho State Tax Tables for 2015 displayed on this page are provided in support of the 2015 US Tax Calculator and the dedicated 2015 Idaho State Tax CalculatorWe also provide State.

Historical Idaho Tax Policy Information Ballotpedia

Combined State And Local General Sales Tax Rates Download Table

Fact 900 November 23 2015 States Tax Gasoline At Varying Rates Department Of Energy

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

The Tax Burden On Personal Dividend Income Across The Oecd 2015 Tax Foundation

Pin By Eris Discordia On Economics Economic Analysis Advanced Economy Developed Economy

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

States With Highest And Lowest Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

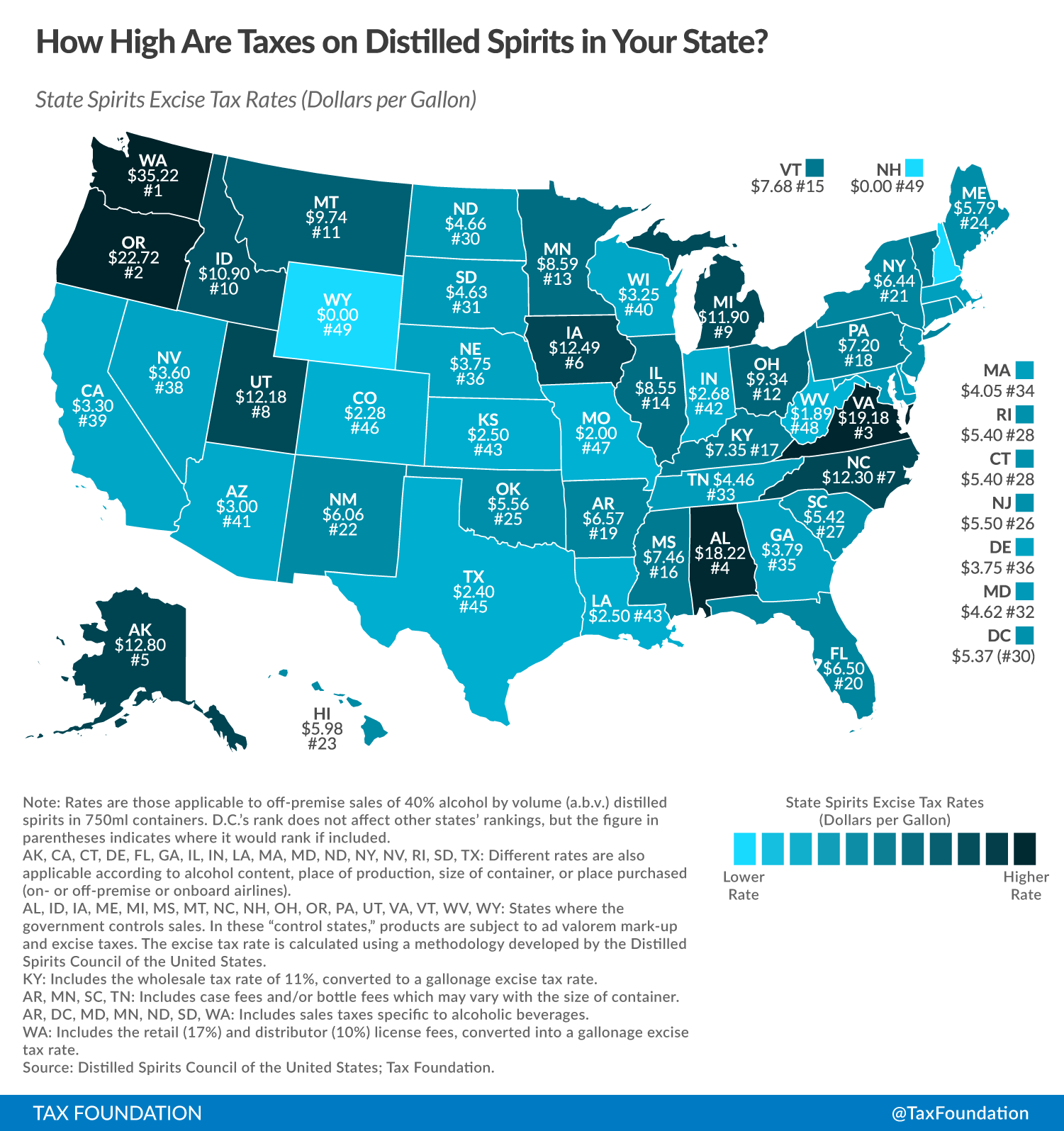

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy

How Do State And Local Individual Income Taxes Work Tax Policy Center

Littourati Main Page Blue Highways Moscow Idaho Idaho Travel Idaho Adventure Idaho Vacation